The smart Trick of Social Security account That Nobody is Discussing

The smart Trick of Social Security account That Nobody is Discussing

Blog Article

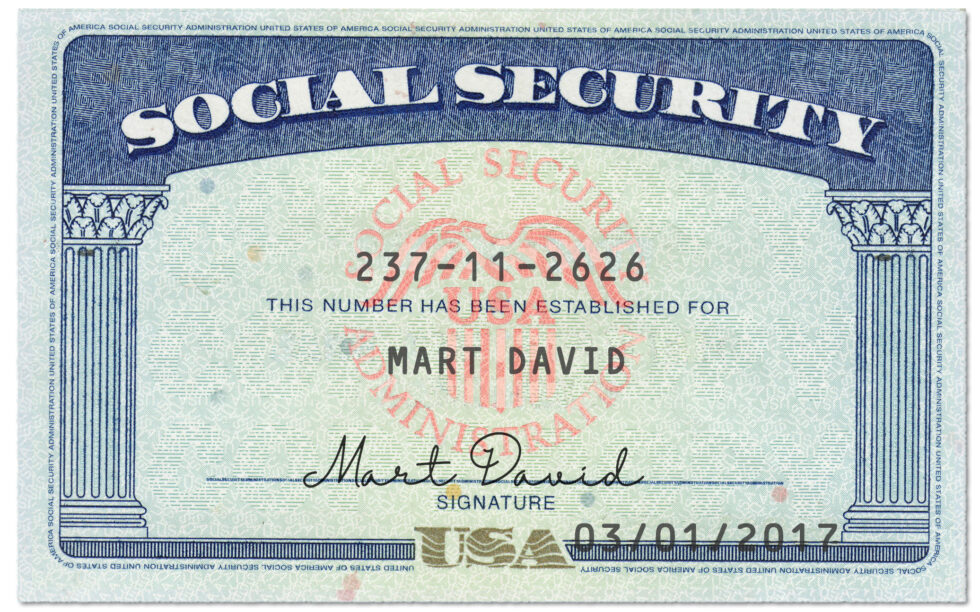

Consequently, a generated SSN may or may not have an actual existence; it only makes sure that there might be a probability of such a pattern till the validation approach is in excess of. After the quantity is verified, the SSN delivers the necessary authentication on the person.

Your original delivery certificate or other evidence of your age. This need to be the original doc or even a certified copy with the issuing company.

T.C.’s division of purchaser reaction and functions. “Lots of situations They can be stating they obtained an impostor connect with and they furnished their facts, they usually feel that is how that data was used to redirect the profit.”

We inspire you to create or sign in to your private my Social Security account to verify your earnings. Your upcoming benefits are determined by the earnings Now we have on your earnings document.

For those who have short-term permission to Reside and get the job done in America, you can find a Social Security card stamped “legitimate for operate only with DHS authorization."

When gathering a variety of parts of a person’s identity, fraudsters might also convert to marketplaces over the dark World wide web, the place Considerably private figuring out information and facts — usually stolen by way of security breaches — is available for purchase.

Social Security Figures are already very practical from time to time, Regardless that it may appear paradoxical to The reality that faking it can be no criminal offense. There have been a lot of buzz in the course of record about Social Security Variety cons, but it surely didn’t pull A great deal public consideration.

June 2, 2021 2:46PM Hello, Jenny. Many thanks for permitting us know. Generally, We'll only Call you For those who have requested a simply call or have ongoing business with us. Lately, cons—misleading victims into earning income or present card payments to avoid arrest for Social Security amount problems—have skyrocketed.

All you must do is create a my Social Security account to accessibility and full the web software.

Social Security-related frauds, In general, are pervasive — fraudsters pose as staff to test to extract both equally income and worthwhile pinpointing facts from persons in a number of evolving schemes.

In addition when investigating fraud in other SSA plans, the Social Security Administration may possibly ask for investigatory support from other regulation enforcement businesses such as the Office environment with the Inspector General along with condition and native authorities.[209]

When you’re not able to submit an application for a substitute card on the internet, consider our Social Security and Coronavirus Online page, under “Social Security Numbers and Cards” heading, for particulars about the files you must mail in with your Social Security card application to secure a substitution card. We temporarily expanded our coverage to accept secondary id files.

"Distributional Outcomes of Lessening the expense-of-Dwelling Adjustments". Social Security Administration Study, Figures, and Policy Assessment. Retrieved January 26, 2020. ^ IRC § 6672 offers "Anyone required to acquire, honestly account for, and fork out in excess of any tax imposed by this title who willfully fails to collect these kinds of tax, or truthfully account for and shell out about this kind of tax, or willfully attempts in almost any manner to evade or defeat any these types of tax or even the payment thereof, shall Besides other penalties supplied by regulation, be liable to some penalty equal to the overall level of the tax evaded, or not collected, or not accounted for and paid around." ^

Originally the advantages received by retirees weren't taxed as income. Beginning in tax year 1984, Along with the Reagan-era reforms to repair the method's projected insolvency, retirees with incomes about $25,000 (in the case of married people filing separately who did not Reside While using the wife or husband at any time throughout the year, and for individuals submitting as "solitary"), or with put together incomes in excess of $32,000 (if married filing jointly) or, in check here certain cases, any money quantity (if married submitting individually in the spouse in a calendar year in which the taxpayer lived With all the spouse Anytime) typically noticed A part of the retiree Positive aspects issue to federal profits website tax.